Turning Sales Into A Growth Engine: How Operational Excellence Accelerates Revenue and Efficiency

(# 023)

Hello subscribers from all over the world. As promised, I’m committed to bringing forth new insights at a more regular frequency. Today, we’re shining a spotlight on a part of business that’s overdue for some operational excellence TLC.

Let’s jump right in and shake things up.

Throughout my career, I’ve always been fascinated by the many moving parts within a typical sales cycle. For starters, you have multiple sales reps spending countless weeks, if not months, winning over the attention and eventual interest of their clients on their way to sending over a proposal.

After this marathon level of effort, and the back-and-forth that exists within the proposal process itself, the precious moment of verbal approval finally arrives. At this point, you’d think they were close to the finish line and ready for execution. Instead, we watch the quote bounce around for many more weeks among pricing, legal, and engineering teams, to name a few. By the time the contract is signed, the prospect’s excitement (and sometimes, unfortunately, the budget) has cooled.

If you ask me, Sales, probably more than most departments, would benefit from a healthy dose of Operational Excellence.

This article explains why treating Sales as an OpEx target creates a compounding competitive edge, then lays out the data, mechanics, and playbook you can put to work next quarter.

Why Sales is Ripe for OpEx

In a nutshell, operational excellence should remove friction, reduce variation, and embed continuous improvement across the board. Most organizations aim those tools at the back of the value stream. Think of areas such as implementation, fulfillment and customer support to name a few. Specifically, areas where ideas finally turn into dollars. Yet the front of the flow, the sales cycle itself, almost never receives an OpEx makeover, and that, in my opinion, is a costly oversight.

When Lean thinking is applied to prospecting, quoting, and hand offs, win rate climbs, sales cycle time falls, and delivery teams start each project with clearer scope and fewer surprises, which is exactly what a thriving company wants. In short, Sales thrives on operational discipline because it translates directly into revenue velocity and market share.

Revenue Is a Flow, Not a Department

Many companies treat sales as a quota factory, chasing numbers and stuffing the CRM with prospects. That mindset misses a simple truth: closing deals hinges on stripping friction from every step of the go-to-cash pipeline.

Like any link in the value chain, Sales is a network of processes that interact and feed one another, each carrying its own friction.

When a proposal ricochets among legal, pricing, and engineering for weeks, even the sharpest salesperson loses momentum. And if a client finally signs but the handoff to implementation stumbles, future upsell opportunities disappear.

OpEx shifts the conversation. Instead of asking “How can salespeople sell more?” we should ask:

“Where in the flow is velocity lost, quality diluted, or context dropped? How does that affect win rate, cycle time, and delivery readiness?”

These are the questions Operational Excellence is built to answer. When applied well, every sales KPI becomes reliable and trends in the right direction.

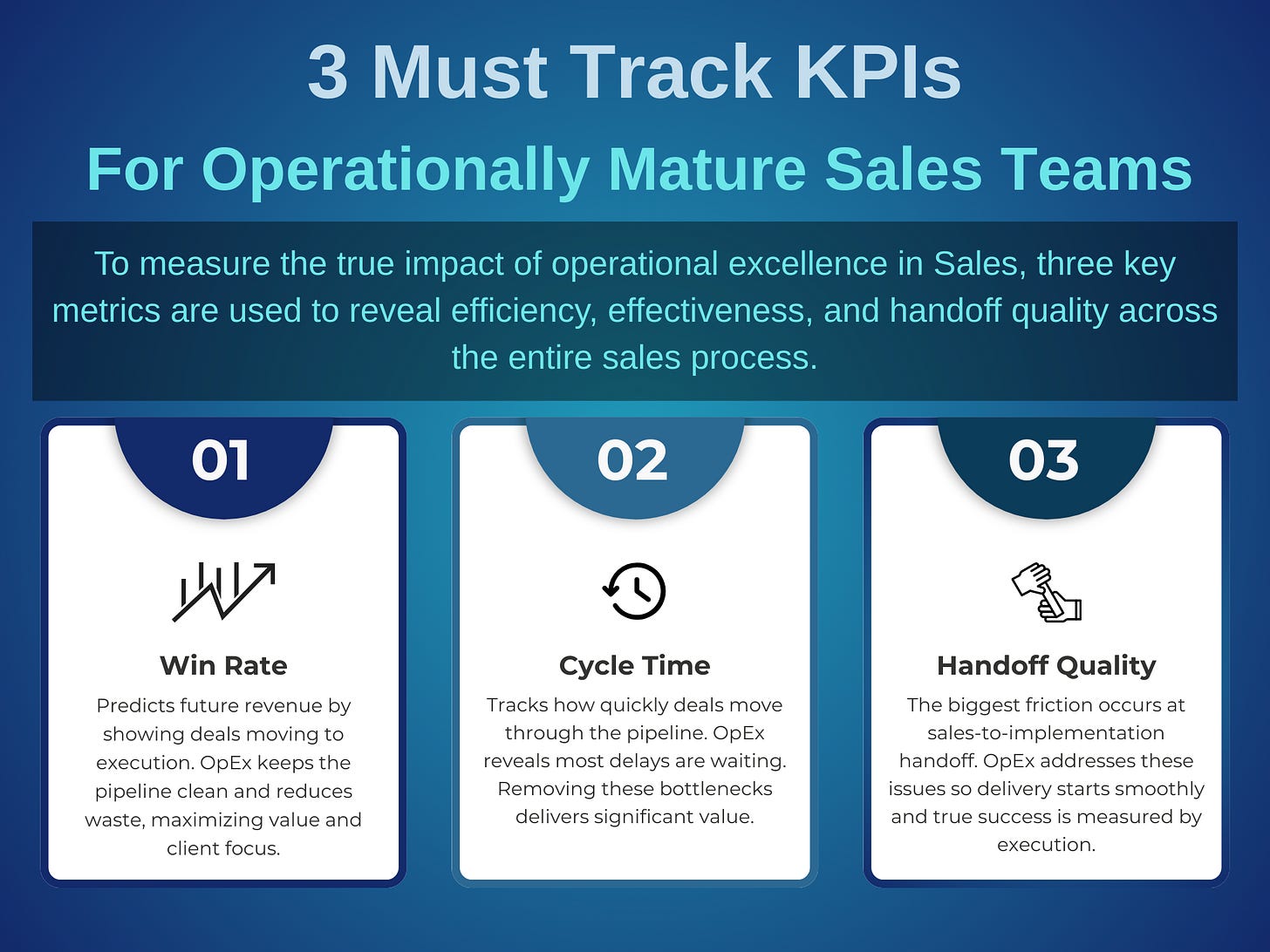

The Three Must-Track KPIs

Speaking of KPIs it’s important to spend a few moments highlighting exactly what should be meticulously tracked to show the full operational status and potential of the sales department. In my experience, the three that follow deliver the clearest 360-degree view of a team’s efficiency and impact.

Win Rate: (Deals Won ÷ Qualified Deals × 100): One of the biggest predictors of future revenue is based on what’s confirmed to pass through the pipeline to the execution area of the business. OpEx can help here by ensuring only clean data is in the pipeline, ensuring days aren’t wasted chasing bad opportunities. Reducing waste in the form of re-quotes is another secondary way we can keep the focus on value and the clients attention high.

Cycle Time (Contract Signed – Initial Opportunity): This one goes without saying and is table-stakes. The faster we can move through the stages in the sales pipeline, the faster we can realize value. OpEx often exposes 60-70 % wait-time in the quote process. If we can figure out specific root cause for this and apply corrective action, you can imagine the amount of value this could bring.

Delivery Handoff Quality (Pass/Fail Checklist Score): One of the biggest areas of friction happens right at the end of the sales cycle and right at the start of brining the sale to life. Issues in scope, timing and product capabilities often delay things significantly and leave a bad first impression with the client. OpEx shines a light on these pain points and offers proactive steps to ensure the delivery teams hit the ground running. As an early mindset shift for sales professionals, they should treat “successful delivery” as the final sales milestone, not the signature.

Your Step-by-Step Lean Playbook

Over the past few months, I’ve been developing a scalable OpEx model that delivers rapid, measurable gains in 90-day sprints. I call it the Maturity to Velocity (M2V) framework: a simple engine that turns survey insights into KPI-driven improvements across every corner of the business.

For most sales teams, which usually sit in the earlier stages of operational maturity, the priority is to reinforce the basics before attempting large-scale optimizations.

Below is my quick start playbook for translating those early fixes into meaningful moves on the KPIs that count.

1. Assessing The Maturity Layer

Data must steer every decision, and Sales is no exception. We start by sending a survey with focused questions that expose the maturity of each business process.

For instance, to find pain points in proposal preparation, we make sure the subject-matter experts and frontline staff involved in that stage are targeted to complete the survey.

Their responses create a clear data set that highlights what works and where friction lives. From there, my team and I target our improvement efforts where they will deliver the greatest impact.

Once you have the data from the sales team, the next step is to sort the feedback into clear segments. In my framework, I use segments designed to be scalable, so they apply beyond a single process or even just the sales department.

I find that visualizations have the most impact with the least effort, because they quickly highlight issues without needing lengthy explanations. That’s why I rely on the heat map as my go-to tool here. Next, it’s time to decide what to tackle first. I’m a firm believer in smaller, steady improvements, so I zero in on the two lowest-performing categories (what I call “red zones”).

Those red zones become your sprint targets, ready to be vetted in the next steps.

2. Measuring Baseline Data

With a clear focus, the next step is to check if your existing data supports what the survey respondents flagged. The goal is twofold: first, confirm that these areas are true pain points, and second, establish your baseline KPIs for measurement.

For sales, I expect the team to gather numbers on the following, both individually and as part of the full sales system:

Qualified Opportunity Count (QO)

Closed/Won Count (CW)

Median Cycle Time between “Qualify” to “Closed-Won”

Re-Quote Rate (opportunities requiring >1 formal revision)

Kick-Off Delay (days from contract to first implementation meeting)

If we are focusing on portfolio preparation as an example, I would look specifically at the numbers for “Qualify” to “Closed-Won,” and compare them to “Proposal Preparation” to “Closed-Won.” Are there major variances in the data? How does this compare to competitors or industry benchmarks? Validating these findings signals you are ready to move into the improvement phase.

If everything checks out, capture screenshots or record timestamped KPIs. Key metrics we talked about earlier such as sales cycle and win rate are ideal. This will be valuable for tracking progress later in the framework.

3. Rapid & Incremental Rollouts

Over the next nine weeks, the focus shifts to hypothesizing solutions, refining them, and rolling them out in the real world. The rollout schedule is flexible, but I recommend splitting the period into three two-week sprints, leaving one week as a buffer. At the end of each sprint, launch a component of the overall solution. This approach delivers value quickly, with the entire cycle taking about 90 days, enough time to show real improvement without overcommitting.

Be sure to start this cycle by highlighting your expected improvements in KPI performance. This sets the right standard and keeps the team focused on the end goal. Here are some sales-specific examples:

Expected KPI Lift:

Win Rate: increase by 2 points (24% to 26%)

Sales Cycle Median: decrease by 9 days

Kick-Off Delay: decrease by 3 days

4. Re-Assess & Embed Wins

The final two weeks are dedicated to closing the loop by validating both the increase in operational maturity and the corresponding improvement in KPIs. At this stage, pull up the KPIs you recorded at the start and take these steps:

Compare outputs: Are you seeing real-world improvements? For example, has the time spent in the proposal preparation stage decreased?

Re-baseline survey: On Day 90, validate progress on the initial pain points by re-administering the survey. The aim is to show measurable gains in the lowest scoring areas from the beginning.

Add key KPIs to your dashboard: Give executives a clear view of how operational maturity improvements translate directly into greater revenue velocity. This also sets the foundation to potential automation in the future.

Optional: If the new survey uncovers fresh pain points, launch another sprint to continue the improvement cycle.

Throughout this process, data remains the driving force, and you always have the option to launch another 90-day sprint for further gains. After the first rollout, the sales team should be convinced of the value that OpEx brings.

Next Steps - Quick Wins

If you want to get started right away and demonstrate the value of a Sales department built on operational excellence, consider implementing some or all of the following practices. These items are listed in no particular order.

Integrated Checklists

Attach the same acceptance checklist used for executive handovers throughout the early stages of the sales cycle. Use a single, unified document connected to the proposal, scope, and kick-off agenda. When Sales marks an item as complete, Delivery already knows the scope is confirmed.Visual Management in Salesforce

Use a Kanban view by opportunity stage, and apply WIP (work-in-progress) limits to columns like “Pricing Review” or “Proposal Preparation.” This approach makes bottlenecks visible, improves forecasting accuracy, and allows Sales Ops to triage issues instead of letting them pile up.“No Surprise” Scorecard at Handover

Create a one-page scorecard (green, amber, or red) for data completeness, integration feasibility, and legal terms. No handoff meeting should happen without a pass. I have seen this type of scorecard cut post-sale changes by 40 percent in a single quarter. When delivery teams do not have to relearn deal context, implementation times drop and NPS scores rise, fueling a cycle that further boosts win rates.Draft a “Definition of Ready” One-Pager: This is for the execution team. Equip Sales with a document outlining exactly what is needed to stay unblocked through to completion. Pilot it with the next five projects, then refine or embed as needed.

Add More fields During Sales Cycle: Track touches and durations between stages to highlight pain points. Automate alerts for any opportunity that remains in a stage longer than expected.

If even one of these steps eliminates a five day delay, you are already on the path to operational excellence.

Conclusion

When Operational Excellence takes ownership of friction points like dirty data, slow approvals, and sloppy handoffs, Sales closes faster, cycle times shrink, and implementation teams begin with clarity instead of confusion. For any organization looking to scale or prepare for an IPO, boosting win rates through systematic process improvement is the most cost-effective ARR you can get.

So the next time someone says, “OpEx? That’s just back-office work,” point to the extra millions in booked revenue that came simply from making deals easier to win and smoother to deliver.